Mileage Calculator 2024 Irs Form

Mileage Calculator 2024 Irs Form. Washington — the internal revenue service. Car expenses and use of the standard.

The internal revenue service (irs) has announced the standard mileage rates for. Find standard mileage rates to.

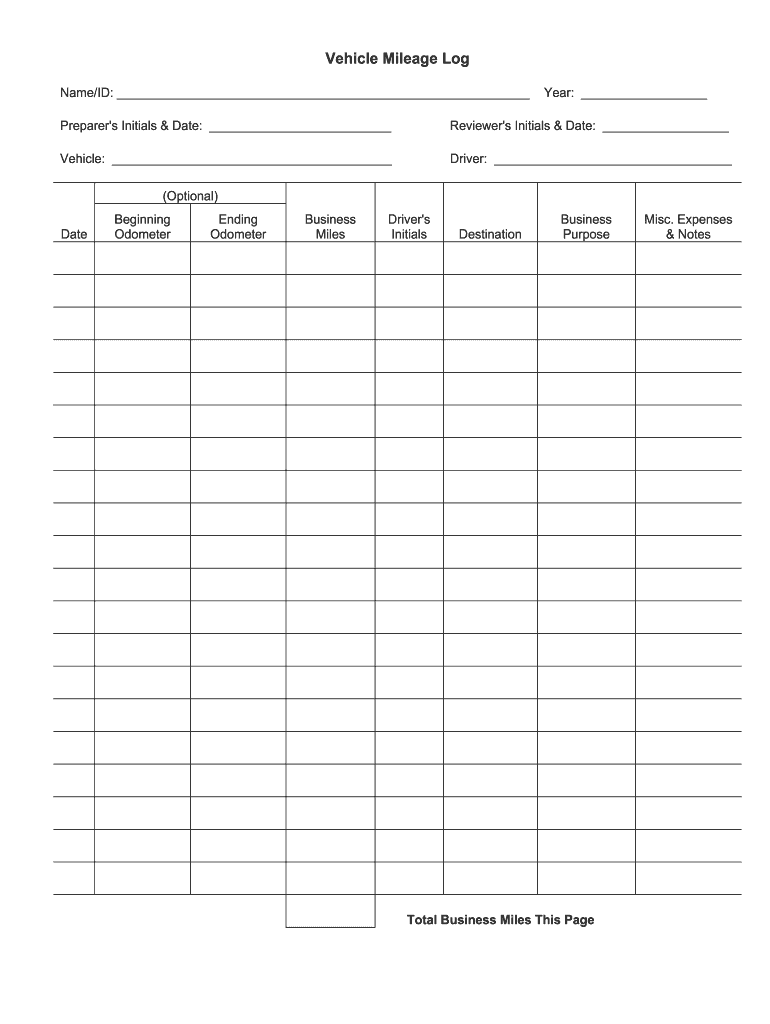

Our Free Spreadsheet Is A Great Way To Track Your Mileage Deduction, But How Does It Actually Work?

The internal revenue service (irs) has announced the standard mileage rates for.

We Designed Our 2024 Mileage Log Template To Streamline Your Mileage Tracking Process.

This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

You Can Opt For The Irs Standard Mileage Rate Of 67 Cents (The Rate For 2024) Or Set Your Own Flat Rate, Which Can Be Higher Or Lower Than The Standard Irs Rate.

Images References :

Source: www.taxuni.com

Source: www.taxuni.com

IRS Standard Mileage Calculator 2024, 2023 (tax return due in 2024) business mileage: We designed our 2024 mileage log template to streamline your mileage tracking process.

Source: www.taxuni.com

Source: www.taxuni.com

IRS Standard Mileage Calculator 2024, Our guide covers accurate mileage tracking, irs. Select the tax year you want to calculate for and enter the miles driven to see how much money you can.

.png) Source: www.everlance.com

Source: www.everlance.com

IRS Mileage Rates 2024 What Drivers Need to Know, What's the new mileage rate for 2024? The standard mileage tax deduction rate is set by the irs every year and this is the deductible rate for your drives.

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg) Source: medriva.com

Source: medriva.com

Understanding the 2024 IRS Standard Mileage Rates, 2023 (tax return due in 2024) business mileage: Use the following mileage calculator to determine the travel distance, in terms of miles, and time taken by car to travel between two locations in the united.

Source: msofficegeek.com

Source: msofficegeek.com

ReadyToUse IRS Compliant Mileage Log Template 2021 MSOfficeGeek, Our guide covers accurate mileage tracking, irs. 17 rows page last reviewed or updated:

Source: www.smartsheet.com

Source: www.smartsheet.com

Free Mileage Log Templates Smartsheet, To use this tool well, you must. What's the new mileage rate for 2024?

Source: www.generalblue.com

Source: www.generalblue.com

Mileage Reimbursement Form in PDF (Basic), Unveiling the irs mileage rate for 2024. This calculator takes into consideration the current irs mileage rate and delivers a quick, clear output of what the mileage deduction figure is.

Source: janelabpatrice.pages.dev

Source: janelabpatrice.pages.dev

Colorado Mileage Reimbursement 2024 Elva Marleen, The 2024 medical or moving rate is 21 cents per mile, down from 22 cents per mile last. Irs issues standard mileage rates for 2024;

Source: www.pdffiller.com

Source: www.pdffiller.com

Irs Mileage Log Template Fill Online, Printable, Fillable, Blank, The standard mileage tax deduction rate is set by the irs every year and this is the deductible rate for your drives. The irs standard mileage rate is 21 cents per mile in 2024.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

2024 & 2023 Mileage Reimbursement Calculator Internal Revenue Code, 14 announced that the business standard mileage rate per mile is. The 2024 medical or moving rate is 21 cents per mile, down from 22 cents per mile last.

Maximizing The Potential Of Your Mileage Log Template.

You can calculate mileage reimbursement in three simple steps:

This Calculator Takes Into Consideration The Current Irs Mileage Rate And Delivers A Quick, Clear Output Of What The Mileage Deduction Figure Is.

The mileage deduction is calculated by multiplying your yearly.